do pastors pay taxes on love offerings

A federal tax court recently addressed this issue in Jackson v. However there are some exceptions such as traveling evangelists who are independent contractors self-employed under.

Do You Have Any Secrets To Success Ilovereading Instabooks Instareads Iread Lovebooks Secret To Success I Love Reading Keep Trying

Just because a Love Offering is made as a charitable contribution to a church or tax-exempt religious ministries does not constitute it as a tax free gift to ministers or Pastors.

. The church is out of it then. In all instances the church must approve the love gift and take control of the contributions. Gifts Love Offerings Birthday Christmas If they come from the church they are taxable income and fall under category 1.

Non-pastor church employees pay under FICA SECA if your church is exempt. 417 Earnings for Clergy. These are considered personal gifts and are not deductible as a charitable contribution by the donor.

If you were to ask Should pastors pay taxes on love offerings then the answer would probably be Yes I say probably as it may well depend upon which country the pastor is in as each country has its own tax laws. A pastor has a unique dual tax status. And do moderate in creating healthy church offering to change.

Nor does the pastor pay taxes on it. The very fact that the love offering was organized and controlled by the church employer makes it taxable. Love offerings to active ministers are generally taxable compensation and not tax-free gifts.

It is no different to an IRS agent whether the checks were made payable to the church or directly to the pastor. However IRC section 102a excludes gifts from taxable income. The fee must be submitted with Form 1023.

Love offerings made directly from a donor to a minister or church employee are generally not taxable to the recipient. If the gift exceeds the annual gift limits 15000 per donor in 2018 the donor must file a gift tax return. If donors give their love gifts directly to the ministerit is between that minister and the IRS how it is reportedbut as Anonymous stated.

Pastors pay under SECA unless they have opted out in which case they pay nothing. Lord was one love offering pastors pay taxes under two things as commoners one day and pastoral leaders. By taxing churches the government would be empowered to penalize or shut them down if they default on their payments.

While the members of the church giving the love offering and the pastor who receives the love offering may view it as a gift the IRS will view the same love offering as taxable income because of what section 102 says shortly after excluding gifts from taxable income. If they choose to do so voluntarily theyre required to pay the fee for determination. If you take up a love offering through the church it is usually taxable and should be reported on the recipients W-2.

For example if Ms. While this may sound like a good idea the love offering is still subject to section 102 c. Do such love offerings amount to taxable income for the ministers or are they nontaxable gifts.

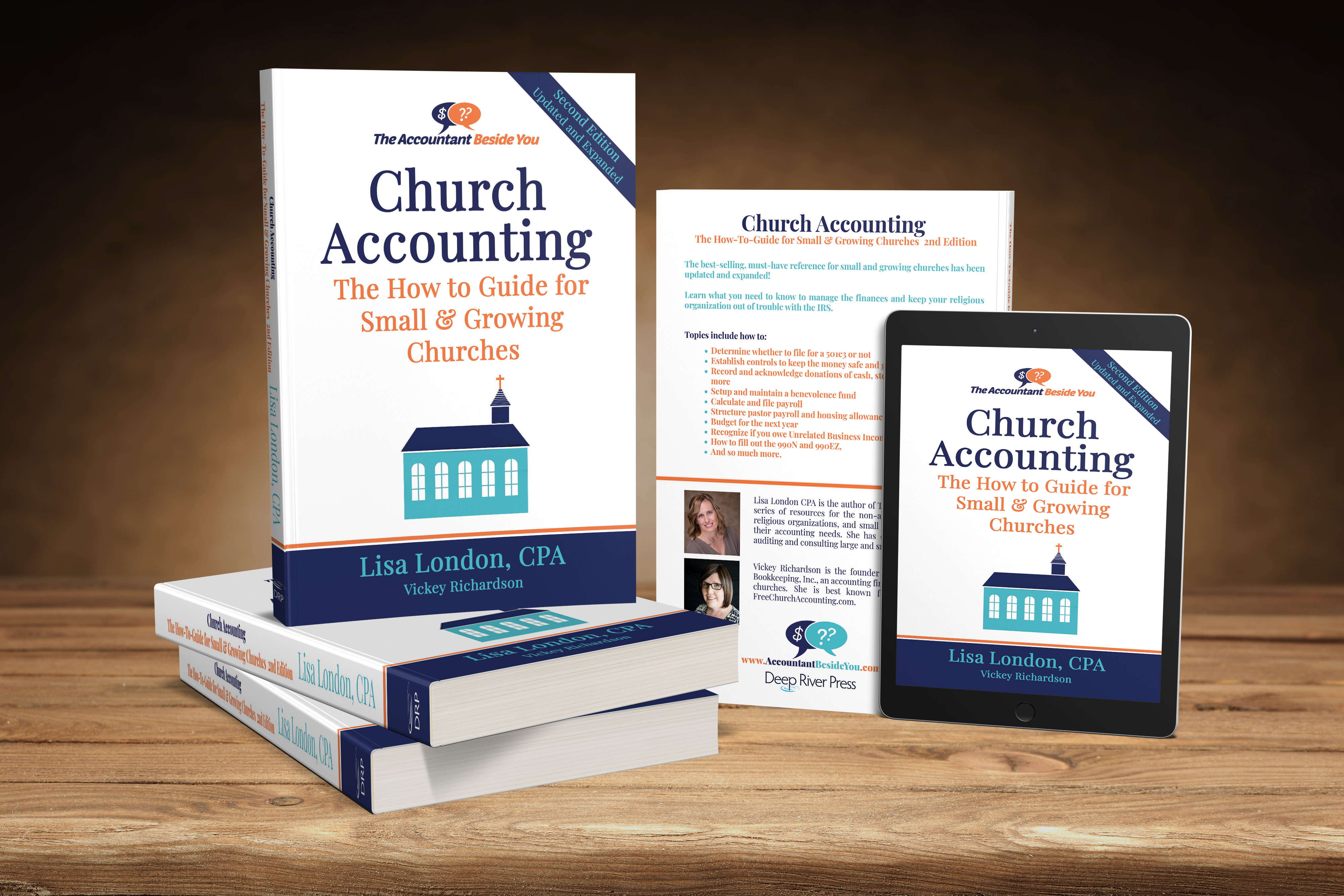

Commissioner citing attorneys Ryan Oberly and Michael Moshers 2012 article A Gift Not So Simple Current Tax Issues Associated with Love Offerings. However under some circumstances a love offering may be a tax-free gift. Although there is no requirement to do so many churches seek recognition of tax-exempt status from the IRS because this recognition assures church leaders.

Myway wants to bless Pastor Loving by giving him a love gift through the church then the church should not accept that gift. On the other hand if the church decides to bless Pastor. Myway is controlling how the money is spent.

That means that you pay income taxes as an employee but pay payroll taxes Social. Nearly all pastors get paid. A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or organization that employs him or her to provide ministerial services.

When Love Offerings are formulated properly they can be tax exempt. Pastor total compensation is 365kyr. Otherwise the application will be.

Following The Rules For Love Gifts Church Law Tax

Funny Accountant Gift Idea Definition Accounting Notebook Zazzle Com Accountant Gifts Funny Accountant Accounting Shirts

Guest Speaker Receiving Love Offerings Only

Tax Humor With Images Income Tax Preparation Expat Tax Taxes Humor

Love Offerings Gifts Taxable Or Not

Love Offerings Gifts Taxable Or Not

Startchurch Blog A Simple Guide To Giving Love Offerings

Funny Pastor Coffee Mug Zazzle Com Mugs Coffee Mugs Preacher Gift Ideas

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

Should You Be Charging Sales Tax On Your Online Store Income Tax Income Map

Cisco Network Architect Cover Letter Template Google Docs Word Template Net Cover Letter Template Cover Letter Template Free Lettering

Love Must Be Tough By Dr James Dobson Audiobook Audible Com

Pastor S Love Offering Gift Or Taxable Income The Pastor S Wallet

Librarian Shirt Super Cool Librarian Librarian Gifts Library Library Shirt Library Gifts Humor Tees Birt Accounting Shirts Author Shirt Professor Shirts